![]()

Homeowners insurance and home warranties are both designed to help safeguard your home, but they each offer different types of protection. A home warranty is an excellent supplement to a homeowners insurance policy, and a homeowner should consider purchasing both.

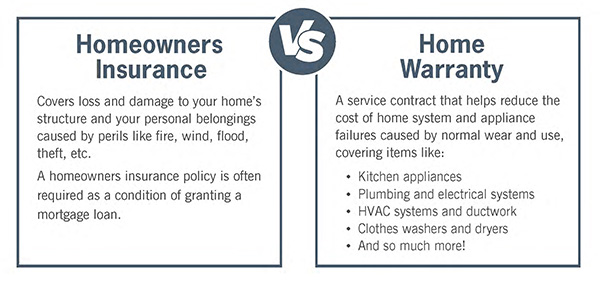

Homeowners insurance covers loss and damage to your home or belongings caused by certain perils such as fire or flood. Most mortgage lenders require a homeowners insurance policy as a condition of granting the home loan.

A home warranty is a service contract that covers the costs associated with common home system and appliance failures. Savvy home sellers and buyers understand the value a home warranty provides both before and after the home sale. Home systems and appliances don’t last forever, and a home warranty plan offers plan holders convenience, budget protection, and peace of mind.

Savvy home sellers and buyers understand the value a home warranty provides both before and after the home sale. Home systems and appliances don’t last forever, and a home warranty plan offers plan holders convenience, budget protection, and peace of mind.

Let’s say a dishwasher leaks in your kitchen, all over your new hardwood floors. While homeowners insurance may cover costs related to the water damage, a home warranty would cover the dishwasher breakdown.

Having both homeowners insurance and a home warranty is a smart idea. They can work in tandem to ensure coverage for the home and belongings within, including the home’s systems and appliances. Together, both types of coverage offer homeowners peace of mind and invaluable budget protection when covered home system and appliance breakdowns happen.